If you analyse your investment opportunity poorly or don’t analyse it at all you might get very poor return on investment or even lose a lot of your money (potentially your whole down payment!). So, tread carefully, just putting money blindly in real estate will likely not work very well.

Luckily there are a lot of resources that you can learn from! I will present you some of my favorite learning resources and tools. I will try to give a variety of examples, some referring specifically to the Irish market, because of the fact that the taxes are much different in Ireland compared to USA. In US the real estate investors pay very little tax, in Ireland it’s a different story…

Learning resources

The analysis is not that hard, but you need to be able to:

- calculate your total necessary upfront investment (purchase related and renovations)

- calculate ongoing operation expenses

- estimate rental income

- budget for bigger expenses

- estimate your taxes

Yup, that’s a lot of things that will likely require quite a lot of research, because many of those might be specific to your market.

Blogs

I’m a huge fan of bigger pockets and I would highly recommend their blog, forums and podcasts. They have a lengthy blog post with the introduction to real estate analysis that I find to be great.

Since I’m not US based, I try to learn from the resources that are closer to home and some time I found out about property hub. It’s a UK based platform with lots of great resources and a solid knowledge base.

The best blog post about rental deal analysis breakdown in the Irish market I found it one by the https://www.informeddecisions.ie/ you can find it here.

Books

If you want something more in depth, I would recommend picking up some Rental Property investing books.

One of my favorite ones is the Book on Rental Property Investing - by Brendan Turner, which was the first real estate book I’ve read. From it you will learn a lot, not only the deal analysis, but also negotiation, due diligence and some property management. Pick it up if you haven’t already and you are serious about real estate investing!

It also looks like the property hub has a bunch of books I haven’t checked them out yet, but they should be a bit more relatable to Irish investors.

And don’t forget to checkout your local libraries! Even during a pandemic, you can order a book to pick up or lend ebooks or audiobooks.

Tools

There are some oldschool people who still use pen and paper to do this, but these days most people would use software ranging from spreadsheet to custom built deal analysis apps.

Even if you aren’t a spreadsheet wizard, you should be able to put together a basic spreadsheet using tools like Google sheets, Excel or libreoffice (open source).

When it comes to custom build apps for this purpose, I am aware of couple of options.

- Bigger Pockets Calculators - calculators that can be used to analyze a wide variety of real estate deals (targetted at US investors), part of the Bigger Pockets platform, free for people having the paid Bigger Pockets membership

- https://dealcheck.io/ - another US centered tool (some functionality is free)

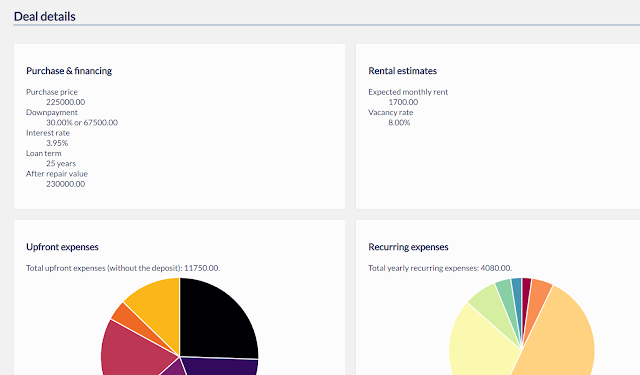

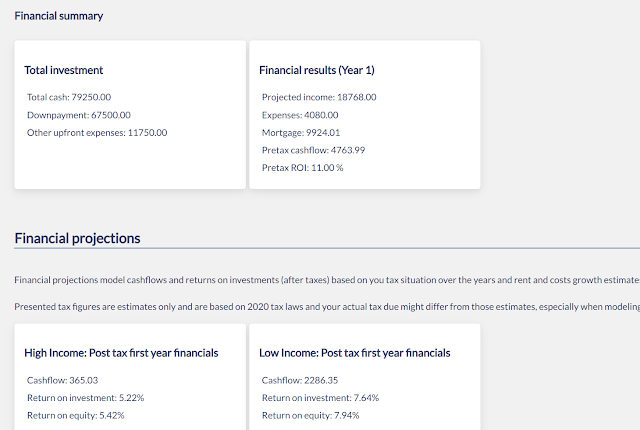

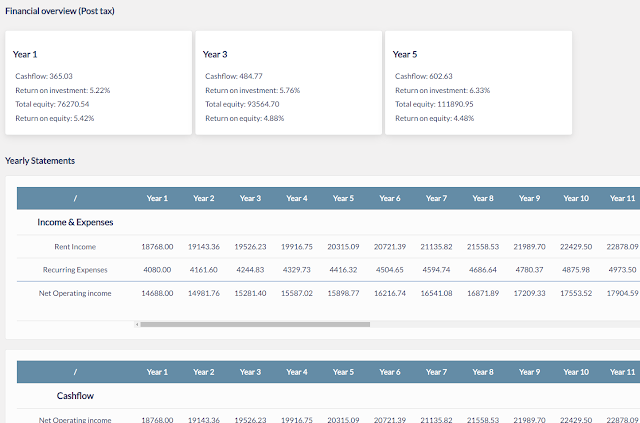

- Redeal - free to use web app targeting Irish property market, see a report created with Redeal

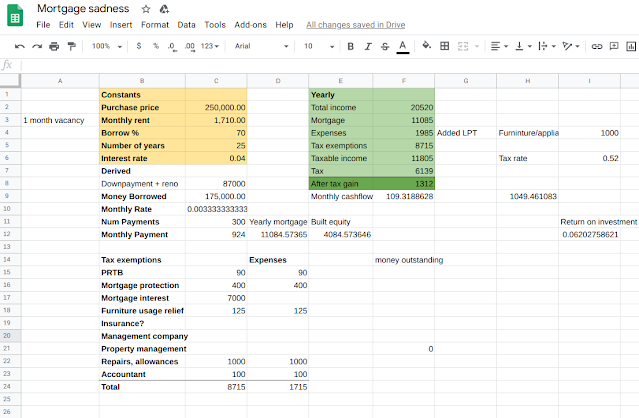

In the past I’ve been using spreadsheets (I bought my two investment properties in Poland this way! and the screenshot above is from one of my custom spreadsheets for Irish market), but lately I’ve been using Redeal for analyzing investments in the Irish market. As a disclaimer, I am involved in the development of the Redeal app and I would like more peoples to know about it and take advantage of it. I would be happy to hear your feedback.

Some redeal screenshots:

- Deal details:

- Financial summary:

- Financial projections:

Summary

The deal analysis is a crucial step of real estate investing. It might turn out that many of the investments you are looking at are not worth it. You just saved yourself a lot of trouble! It’s very easy to assume the best and forget about various expenses, such as repairs, insurance or property management (I am guilty of that myself!). Standard spreadsheets or custom built software will help you avoid rose-color glasses.

I hope you will find those resources helpful! See you next time!